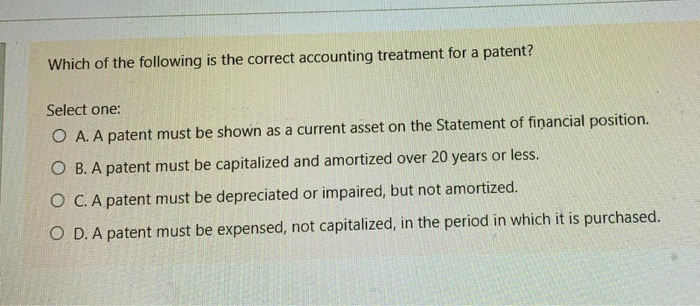

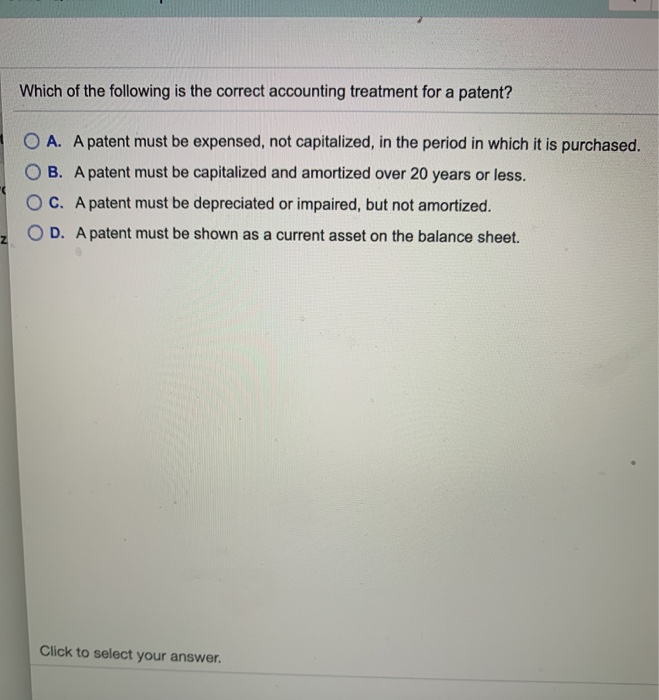

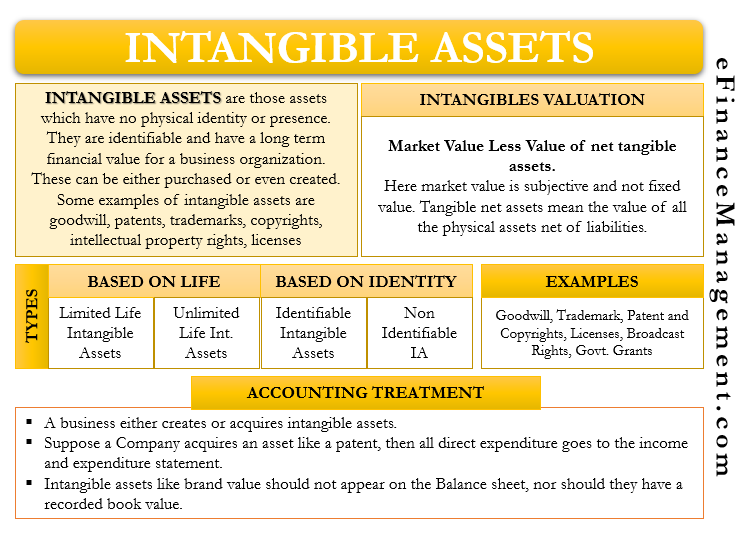

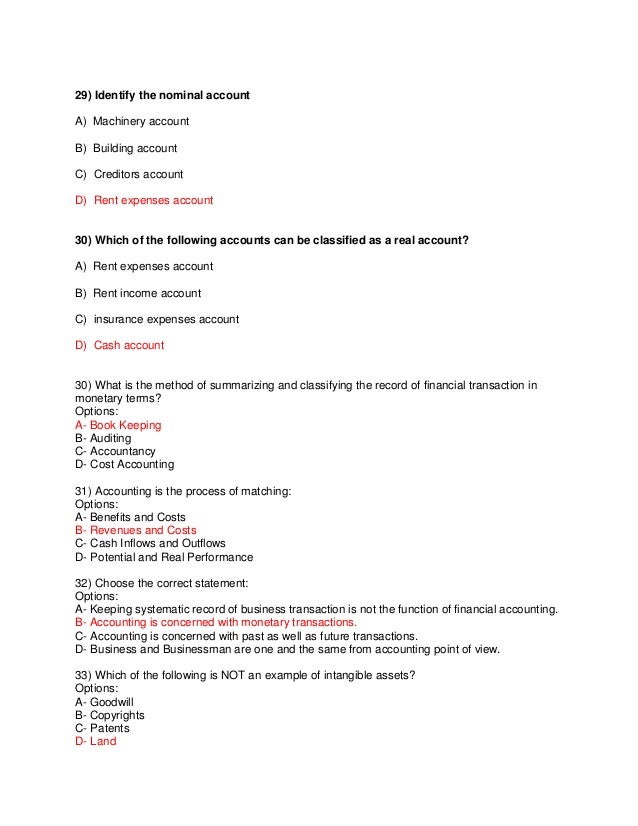

Which Of The Following Is The Correct Accounting Treatment For A Patent?

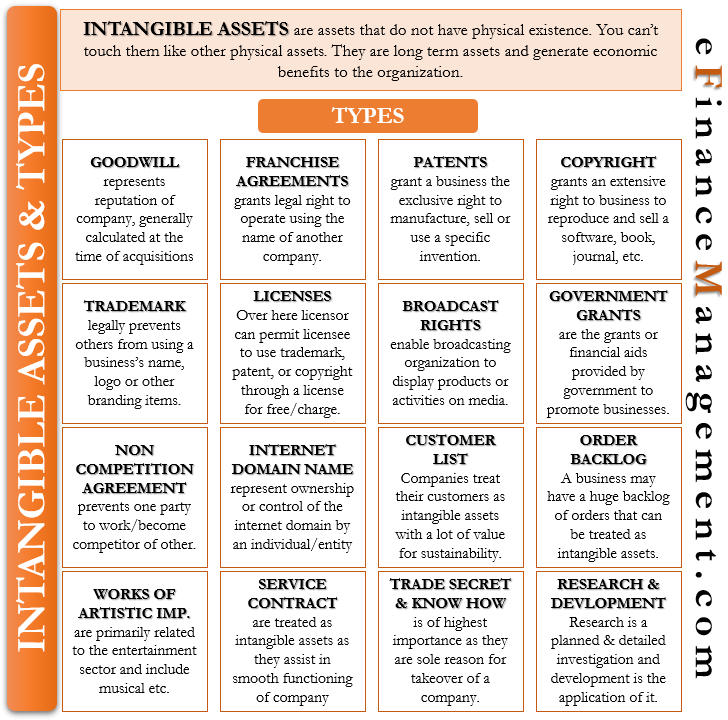

Which of the following is the correct accounting treatment for a patent?. AShort-term capital losses are not deductible. As such the accounting for a patent is the same as for any other intangible fixed asset which is. A patent must be shown as a current asset on the Statement of financial position.

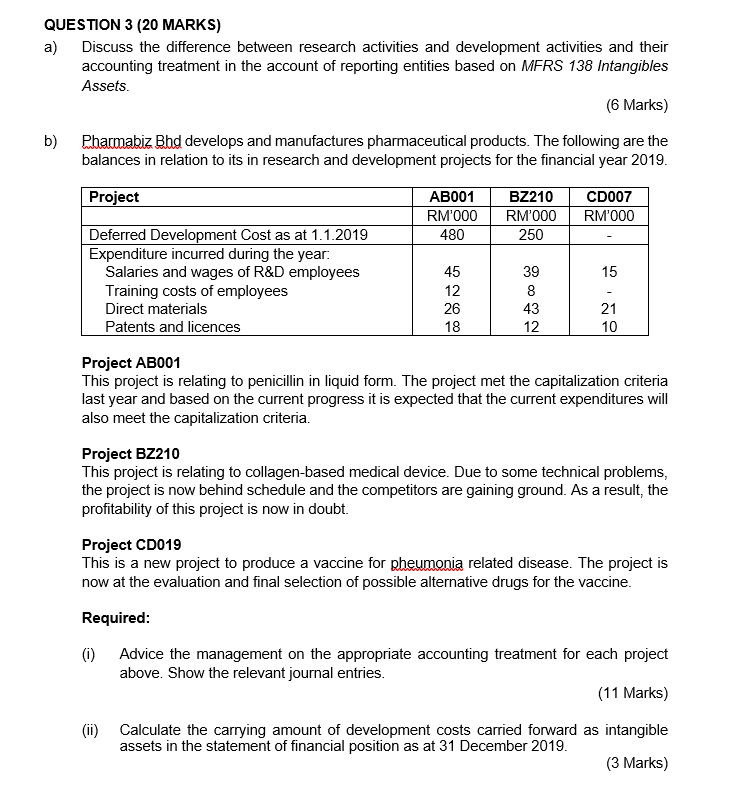

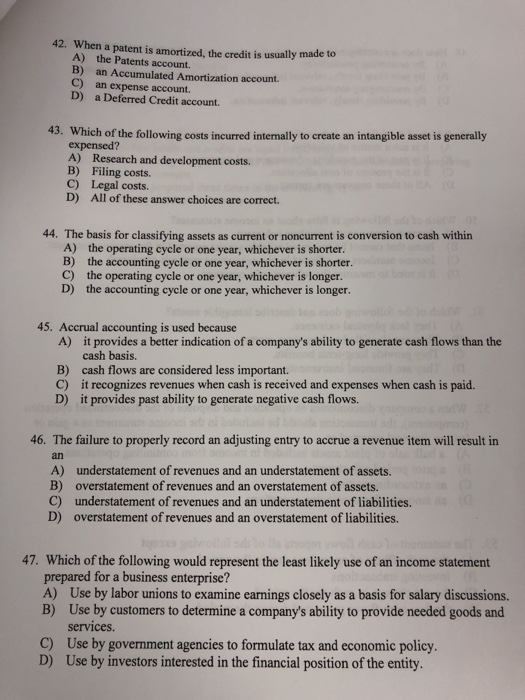

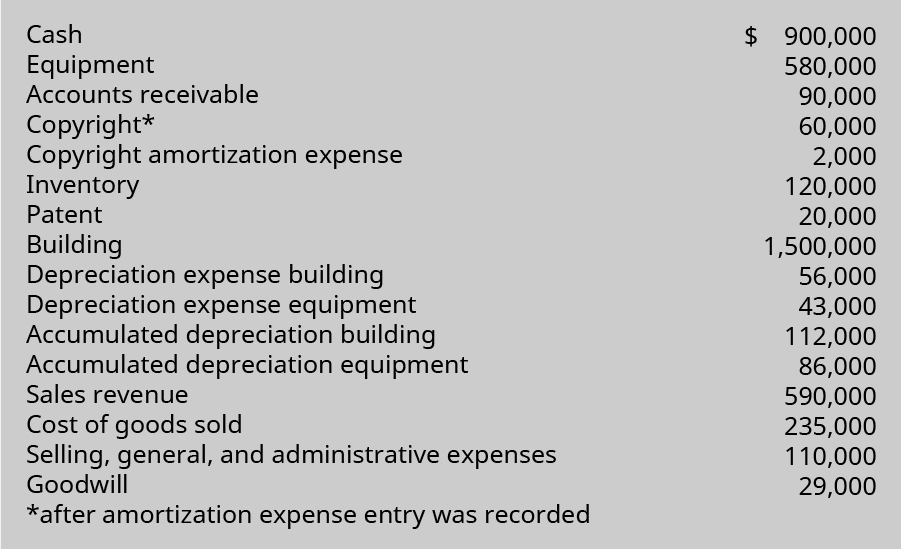

Which of the following is the correct formula for calculating deprecation under the straight-line method. The appropriate accounting treatment is that. A Straight-line depreciation Cost Residual value Useful life B Straight-line depreciation Cost - Residual value Useful life C Straight-line depreciation Cost Residual value Useful life.

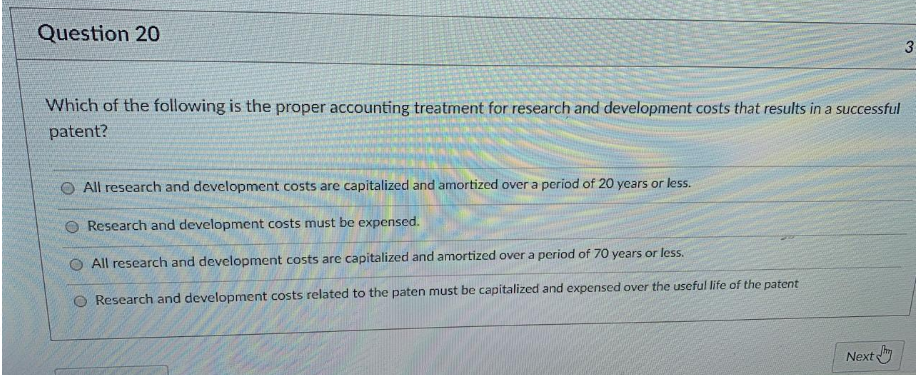

Which of the following is the correct accounting treatment for a patent. Which Of The Following Is The Proper Accounting Treatment For A Purchased Patent. Preliminary costs should be capitalized as incurred.

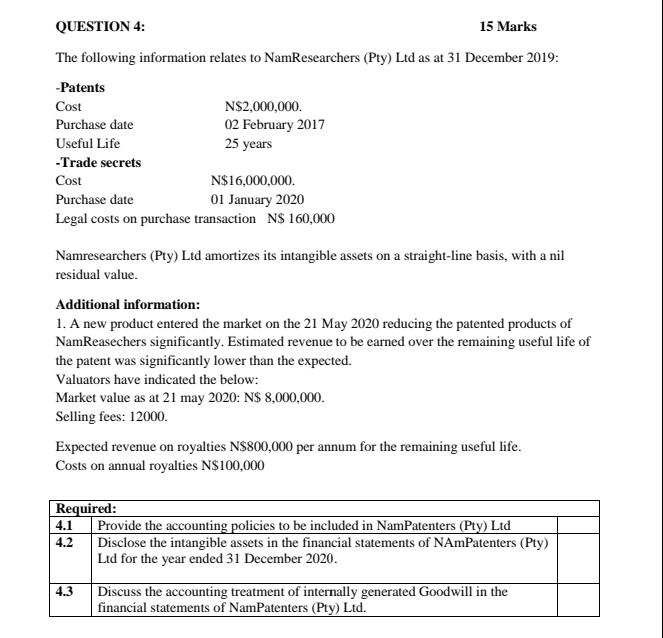

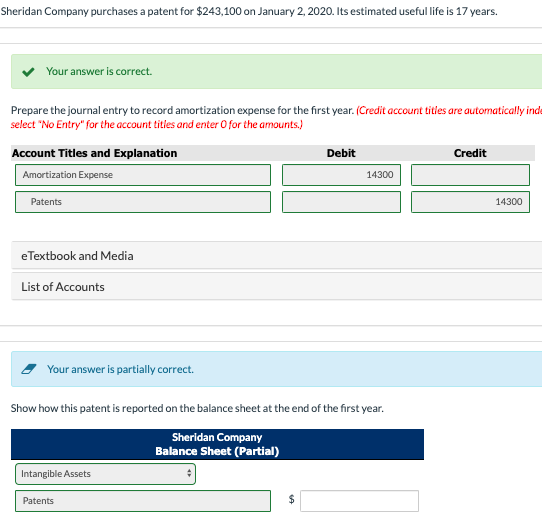

Option B This is correct because this is a possible obligation that may result in a flow of funds to claimants depending upon the outcome of the case. The life of such a patent is either 20 years from the date of original filing or the patents useful life whichever is shorter. Correct Washburn is required to adjust a change in accounting estimate prospectively.

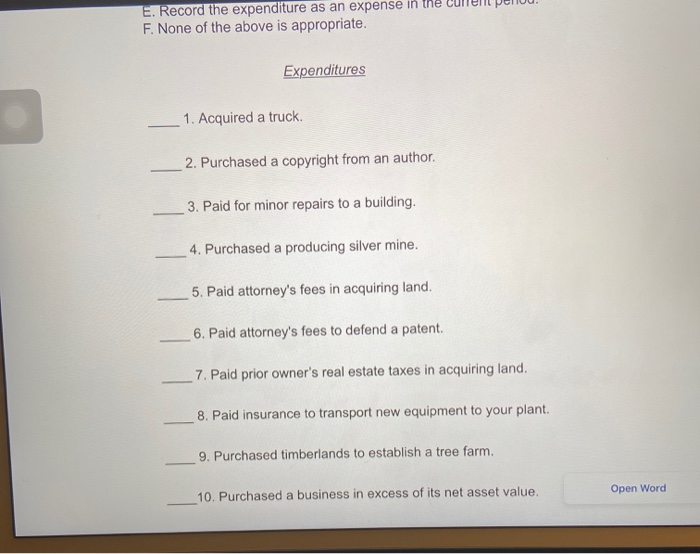

A patent must be shown as a current asset on the balance sheet. A Purchased Patent Must Be Expensed A Purchased Patent Must Be Capitalized And Expensed Each Year To The Extent That The Value Has Declined A Purchased Patent Must Be Capitalized And Amortized Over 20 Years Or Less. Which of the following is the correct accounting treatment for a patent.

BNet capital loss is deductible only up to 3000 per year for individual taxpayers. Record the cost to acquire the patent as the initial asset cost. A patent must be depreciated or impaired but not amortized.

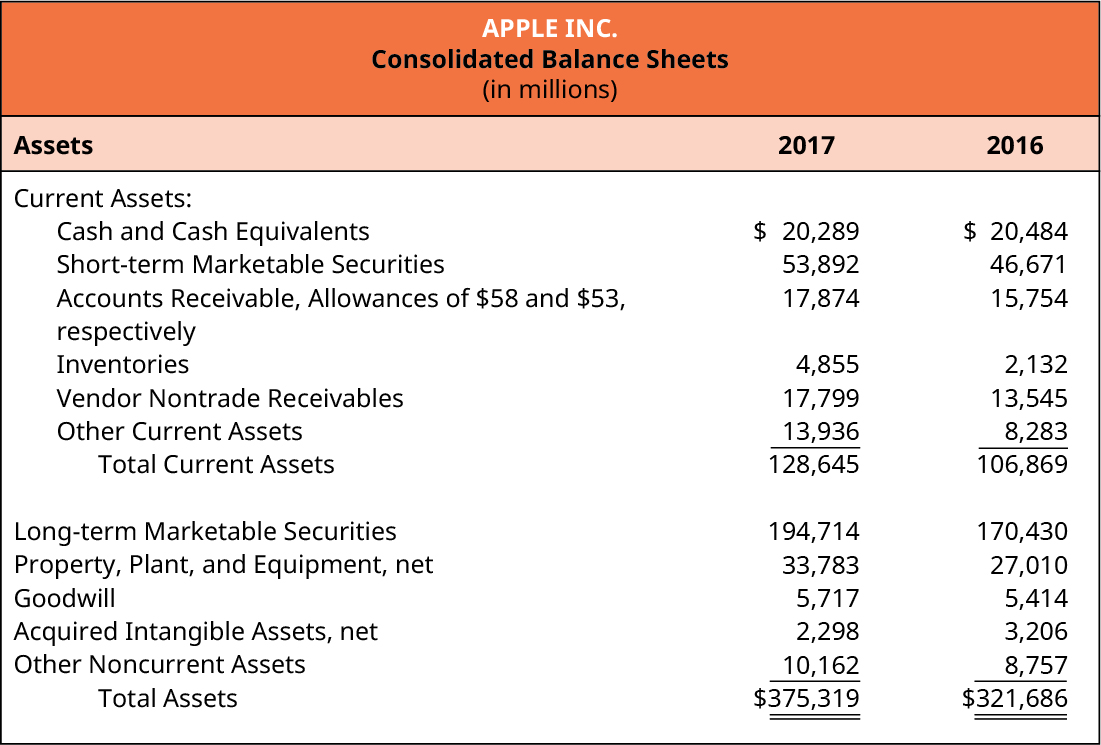

The correct order of presentation in a classified balance sheet for the following current assets is. Washburn needs to correct an accounting error.

A 45000 two-month 9 note payable was issued on December 1 2018.

Washburn has made a change in accounting principle requiring retrospective adjustment. Preliminary costs should be capitalized as incurred. The life of such a patent is either 20 years from the date of original filing or the patents useful life whichever is shorter. It is probable that the future economic benefits that are attributable to the asset will flow to the entity. A patent must be expensed not capitalized in the period in which it is purchased. Cash accounts receivable inventories prepaid insurance. Washburn has made a change in accounting principle requiring retrospective adjustment. And b the cost of the asset can be measured reliably. A Straight-line depreciation Cost Residual value Useful life B Straight-line depreciation Cost - Residual value Useful life C Straight-line depreciation Cost Residual value Useful life.

AShort-term capital losses are not deductible. It is shown on the balance sheet as a current liability. Legal fees and other direct costs incurred in registering a patent should be capitalized and amortized on a straight-line basis over a five-year period. A 45000 two-month 9 note payable was issued on December 1 2018. A patent must be depreciated or impaired but not amortized. Cash inventories accounts receivable prepaid insurance. And b the cost of the asset can be measured reliably.

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Post a Comment for "Which Of The Following Is The Correct Accounting Treatment For A Patent?"